Exploring the Forex Market

🌍 Welcome to the World of Forex Trading! 💰

At Quant Funded, we're here to guide you through the fascinating world of forex trading. In this blog, we’ll explore the structure of the forex market, major currency pairs, and how to understand currency price quotes—all essential knowledge for becoming a profitable trader. 🚀

🏛 Structure & Organization of the Forex Market

The forex market is a decentralized global marketplace where currencies are traded electronically via Over-the-Counter (OTC) transactions. Unlike stock markets, forex trading does not rely on a central exchange.

Key Features of the Forex Market:

✅ No Central Exchange – Trades happen through a vast network of financial institutions, including banks, brokers, and trading platforms.

✅ 24/5 Global Accessibility – The market operates 24 hours a day, five days a week across different time zones, ensuring continuous trading opportunities.

✅ The Interbank Market – The largest forex transactions occur between banks to facilitate international trade and manage currency risks.

💱 Major Currency Pairs & Their Characteristics

Currency pairs are at the core of forex trading. They consist of a base currency and a quote currency, with the exchange rate indicating how much of the quote currency is needed to buy one unit of the base currency.

🌟 Major Forex Pairs:

📌 EUR/USD – The most traded pair, known for its high liquidity and tight spreads. Often reflects global market sentiment.

📌 GBP/USD ("Cable") – Popular due to the economic strength of the UK & US.

📌 USD/JPY ("Ninja" or "Gopher") – Heavily influenced by Japan’s economic policies and global risk sentiment.

📌 USD/CHF ("Swissy") – Often acts as a safe-haven currency, reflecting market uncertainties.

📊

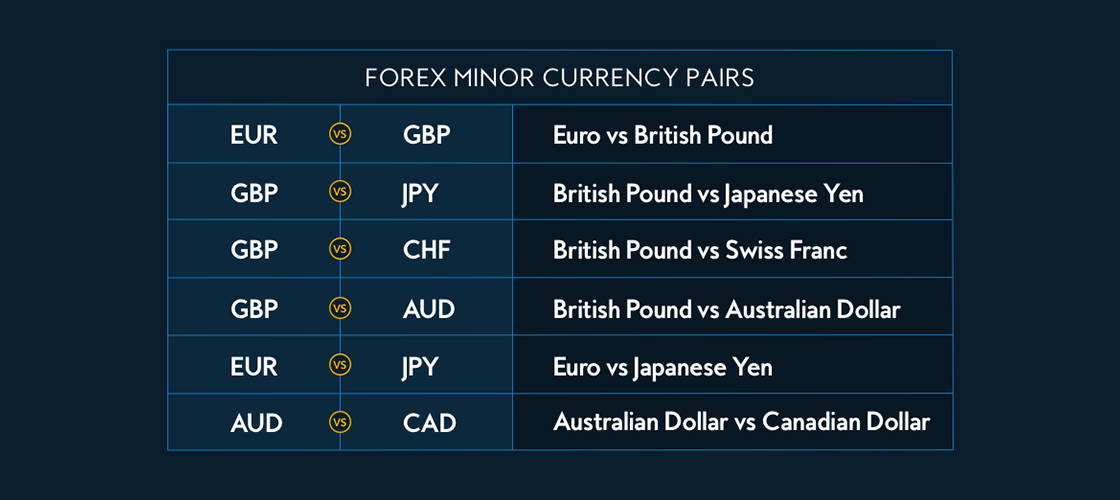

🔄 Minor Currency Pairs (Cross Pairs)

Unlike major pairs, minor currency pairs do not include the US dollar. They often feature economically strong currencies from different regions.

🌍 Examples of Minor Pairs:

🔹 EUR/GBP – Affected by EU & UK economic relations.

🔹 GBP/JPY ("Guppy") – Highly volatile due to economic factors in the UK & Japan.

🔹 AUD/CAD – Influenced by commodity prices and trade relations.

🔹 NZD/JPY – A combination of an export-driven economy (NZD) with a major industrial nation (JPY).

🔹 EUR/AUD – Reflects the economic relationship between Europe and Australia.

📊

📉 Understanding Currency Rates & Forex Price Quotes

🔹 Bid & Ask Prices:

💵 The Bid Price – The price at which traders can sell the base currency.

💵 The Ask Price – The price at which traders can buy the base currency.

🔹 Spread:

🔎 The difference between the Bid & Ask price. A lower spread means lower transaction costs!

🔹 Pips:

📍 The smallest price movement in a currency pair.

📍 For most currency pairs, 1 pip = 0.0001, except for JPY pairs, where 1 pip = 0.01.

🚀 Start Your Trading Journey with Quant Funded!

📈 Understanding forex market structure, currency pairs, and price quotes is essential to becoming a successful trader. With Quant Funded, you can hone your skills, explore trading strategies, and take advantage of market opportunities.

🔥 Join Quant Funded today and take the first step toward forex trading success!